Supply Growth to Hold the Luxury Property Prices in 2019

The luxury real estate company Unique Estates presented its analysis of the property market in Bulgaria for 2018. Among the outlined trends and forecasts are:

The Sofia city center, as well as the Lozenets district and the vicinity of Doctor’s Monument in the capital are the most demanded areas for renting and buying an apartment in Bulgaria in 2018.

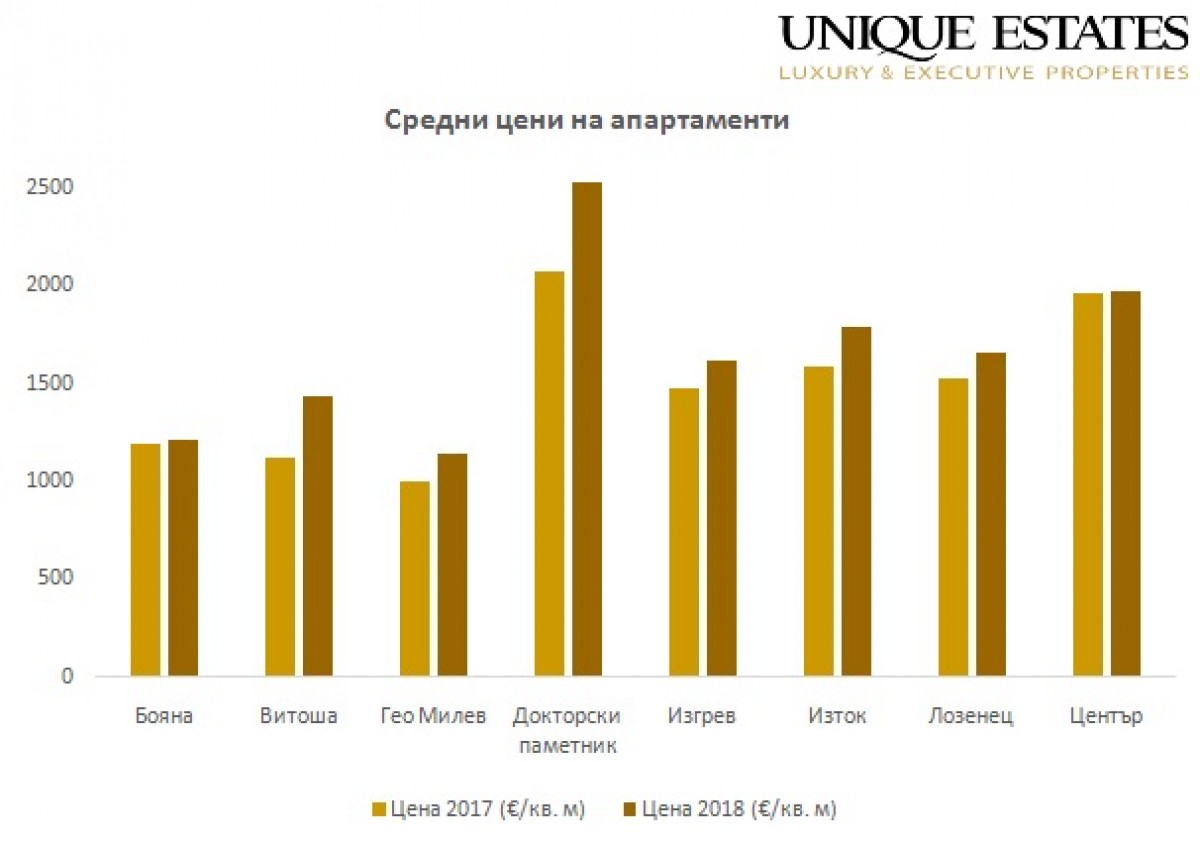

Luxury property prices in Sofia have risen by an average of 6% in 2018.

High-end residences remain attractive for investment.

Overview

The luxury property market enters a period of increased supply, which will lead to more choice for buyers and to keep prices around the levels already reached. Their rapid growth over the past two years has led to a slight, but lasting decline in deals due to the harder purchase decision. In 2019, a substantial change in activity is not expected, and the market will work for buyers.

Growth in the economy, low interest rates and credit increase will continue to play a key role both in the residential market and the luxury property segment. Demand for housing remains a leading one, but high-end properties are also a good investment in terms of the possibility of stable returns and long-term growth potential.

Supply and Demand

Despite the emergence of new attractive locations for buyers, the established areas such as the Sofia city center, the Lozenets district and the region around the Doctor’s Monument remain leading in number of deals, according to Unique Estates.

While in the central part of the city, and especially in the vicinity of Doctor’s Monument, the supply is traditionally driven by apartments in old aristocratic apartment houses, in the Lozenets district an incentive in the past year was the emergence of new residential projects. As a result, in 2018 there was a slight rise in prices and almost double sales growth in the luxury segment.

At the same time, the appreciation of the properties has led to an outflow of buyers in the region of Doctor’s Monument, although the supply there has been rising over the past year. Higher price levels were less likely to meet buyer expectations, resulting in a reduced number of deals. Unique Estates’ statistics show that in 2018 residential prices in the region were in the range of EUR 2,800-3,000 per sq.m, and in single transactions even exceeded this limit. At the same time a year ago, the most expensive sales in this part of Sofia were in the range of EUR 2,300-2,450 per sq.m.

According to Svetoslava Georgieva, Operations Director of Unique Estates, Izgrev is also among the districts deserving attention in recent months. “The emergence of high-end projects on Tintyava Street led to a rise in sales prices to an average of EUR 1,600 per sq.m and so Izgrev is catching up with Lozenets. The new construction changed the appearance of the area and placed it in the upper price segment,” she specified.

New neighborhoods such as Vitosha and Krastova Vada have also big potential, especially in the part around the Vitosha metro station and Paradise Center.

The Sofia city center, the districts of Lozenets and Iztok as well as the area around Doctor’s Monument have registered a high rental activity in 2018. In these areas the demand for apartments for rent is leading, while in the segment of houses top neighborhoods are the ones on the Vitosha collar – Boyana, Simeonovo and Dragalevtsi.

Prices

The past year reports a minimal price increase of luxury properties – an average of 6%, and overall a period of sobering on the market. The flat growth in supply and the reaching of buy-in prices have exhausted the potential of the market for appreciation and the expectations for the current year are to keep the levels already reached.

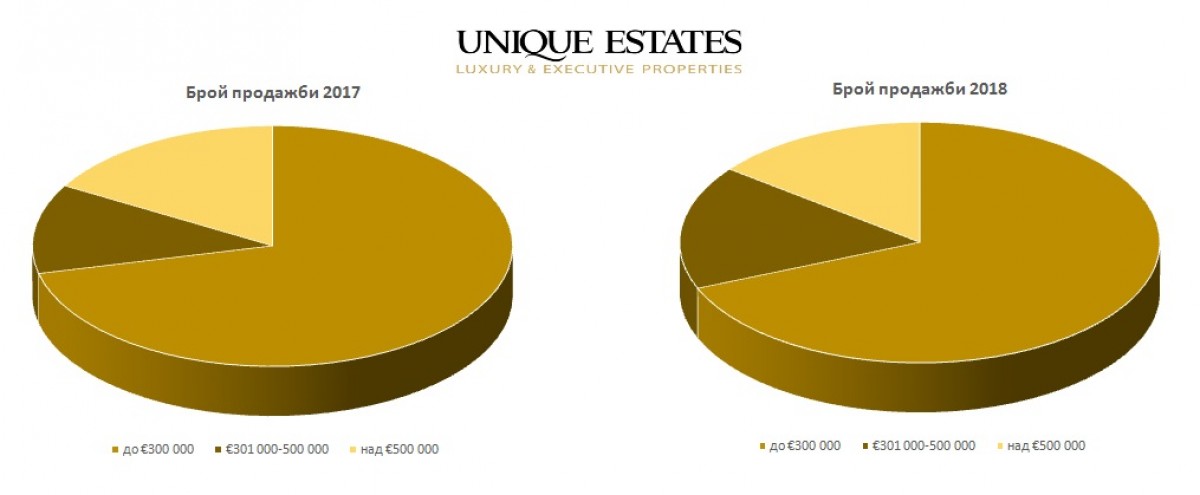

In 2018, the share of discount transactions has also increased. If, in 2017 about half of the luxury segment purchases were negotiated with a discount on the offer price, a year later their share has risen to just over 70% of the total.

“The trend that we have seen since last year is a market that is increasingly driven by buyers. This trend will continue this year and in practice means that in more and more deals we will see price bargaining so overvalued properties will stay for months on the market,” Svetoslava Georgieva predicts.

Unique Estates’ statistics show that the average discount in 2018 was 7.4%, for apartments – under 7%, and for houses – over 10%. The biggest share of last year’s sales has been the one with discount of 5% of the offer price, which is a sign of a gradual balancing of the market.

A noticeable trend in the recent months has been the reorientation of many buyers in the highest segment of the market – over EUR 500,000, from houses to small business investment. This category mainly includes deals where customers have EUR 1 to 3 million and look for a good investment for their money. Because of the better rental market, these funds are often directed to small business properties – apartment houses, as well as office buildings with 1,000-1,500 sq.m of unfolded built-up area. The market also knows cases where newly-built residential buildings are turned into offices for the needs of small companies from the consulting business, technology, pharmacy, law firms, etc.

“In this segment there is a specific demand from companies that are growing and looking for office buildings to buy space in. These are smaller companies that move from rent to ownership and want a representative property, a more fragmented environment, not a typical business location,” Svetoslava Georgieva shares.

According to her, although the potential for price growth at this stage is limited, luxury properties remain a good investment, mainly because of their price stability and the fact that they are well protected against inflation. There is a noteworthy decline in speculative deals in the central part of Sofia, which is seeking a rapid rise in value and resale.