Dubai’s real estate market continues to defy global trends with impressive upward growth, particularly in the luxury segment. As of 2024, the market is witnessing sustained price appreciation driven by robust demand for high-end properties, strategic economic development, and resilient fundamentals. This article explores the factors behind Dubai's price surge, considers how long this trend may continue, and examines whether there is a risk of a market bubble.

Dubai’s real estate market is highly attractive to local and international investors, driven by several key factors:

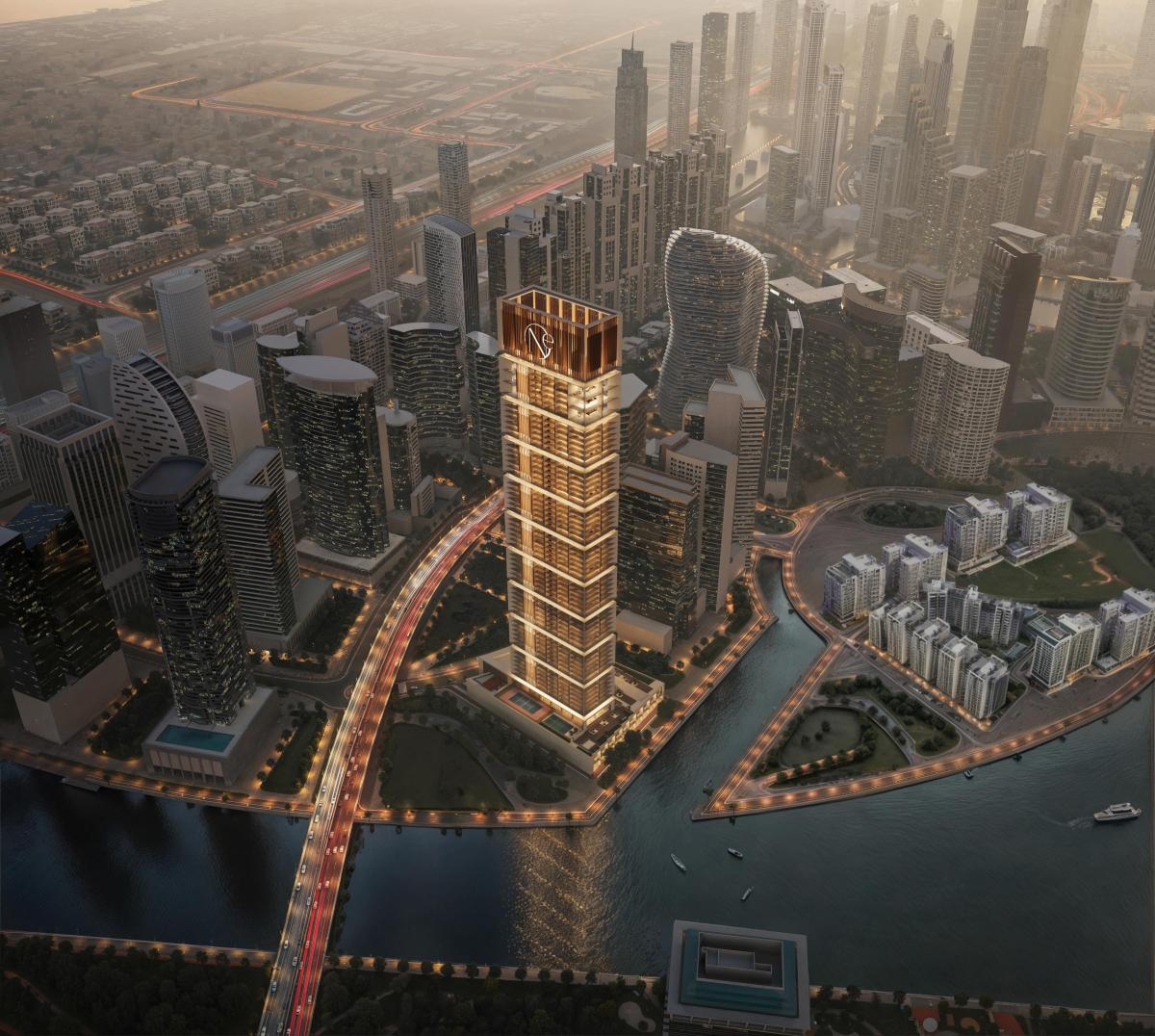

Dubai has become a global hub for high-net-worth individuals who are drawn to its luxury lifestyle, high-quality infrastructure, and tax-free environment. Demand for iconic locations, including Palm Jumeirah and Downtown Dubai, is especially high, with prime property prices appreciating up to 12% annually. Buyers are willing to pay a premium for properties with panoramic views, creating competition and driving prices up.

Dubai's commitment to infrastructure, from world-class transportation to high-end healthcare, strengthens its appeal as a residential and investment destination. The city’s connectivity and investor-friendly regulatory environment attract foreign buyers seeking a stable, growth-oriented market. These strategic developments are supported by government policies, which foster a stable market for investors by balancing supply and demand.

The demand for sustainable, tech-integrated luxury developments is another factor in Dubai’s rising prices. High-tech, eco-friendly projects like The Sustainable City and Dubai Creek Harbour reflect a growing emphasis on sustainability, aligning with global trends. As more investors prioritize green and technologically advanced properties, Dubai’s integration of digitalization—such as virtual property tours and cryptocurrency-based transactions—adds modern appeal that attracts a new generation of buyers.

Analysts remain optimistic that Dubai’s real estate market will continue growing through 2024 and beyond, particularly in the luxury sector. Several factors suggest sustained demand and price growth:

Luxury properties in Dubai remain competitively priced compared to other global cities like New York and London, allowing investors to acquire more space and amenities for their money. For example, a $1 million property in Dubai provides far more square footage than in other metropolitan areas, which makes Dubai’s luxury real estate appealing on a global scale.

Dubai has maintained a steady supply-demand ratio through government oversight, which helps to avoid the risks of an overheated market. This regulatory stability, combined with Dubai’s commitment to sustainable, high-tech developments, contributes to ongoing confidence in steady price increases. External factors, like global interest rates and geopolitical shifts, may moderate growth, especially in the affordable housing segment. Still, analysts expect high demand for prime properties to continue driving annual price increases.

While rapid appreciation in prices can sometimes signal a bubble, Dubai’s real estate sector currently appears stable and resilient. Dubai's market has shown proactive management of potential risks, reflecting a focus on controlled, sustainable growth rather than speculative surges.

Developers in Dubai are focusing on high-end, limited-edition projects, carefully managing the supply of residential units. By limiting oversupply, Dubai avoids the risk of saturation that could destabilize prices. This focus on quality over quantity helps mitigate the likelihood of a market correction.

Dubai’s government has taken measures to ensure long-term stability, including regulations on foreign ownership, property financing, and rental controls. These strategies prevent over-speculation and create a balanced environment for investors. Additionally, incentives for sustainable construction and innovation, such as green building requirements, help foster a stable and attractive investment climate that supports sustained growth without overheating.

Dubai’s real estate market continues to set new benchmarks, buoyed by high demand for luxury and prime properties, a strong economic foundation, and strategic infrastructure development. While external factors like rising interest rates or geopolitical issues could introduce some challenges, Dubai’s resilient fundamentals and proactive regulatory oversight make a significant price correction unlikely. Instead, the market is expected to experience moderate, sustainable growth, cementing Dubai’s status as a global hub for luxury real estate and investment.

For investors and buyers, Dubai’s market presents unique opportunities for both lifestyle and financial growth. With a focus on luxury, sustainability, and innovation, Dubai remains one of the world’s most appealing real estate markets, offering a mix of stability, value, and long-term potential.